13 February 2024

The Continuous Mortality Investigation (CMI) has released a consultation on its proposal for the next annual update to the CMI Mortality Projections Model, CMI_2023, which it intends to release in April 2024.

If the proposal is adopted, CMI_2023 would produce cohort life expectancies at age 65 that are very similar to those in the previous version of the CMI model, CMI_2022 – around one week lower for males and one week higher for females.

The CMI Model is used by UK pension schemes and insurance companies which need to make assumptions about future mortality rates. While mortality experience in 2020 and 2021 will affect actuarial calculations, mortality in both of those years was exceptional and is unlikely to be indicative of future mortality. For this reason, the CMI places no weight on the data for 2020 and 2021 in the core version of the model, effectively ignoring those years.

More recent mortality has been less volatile and is more likely to be indicative of future mortality to some extent. Standardised mortality rates based on registered deaths in England & Wales in 2023 were similar to the 2015-2019 average and lower than in 2020, 2021 and 2022. Given that, the CMI proposes placing 10% weight on data for 2022 and 2023 when calibrating CMI_2023 while still placing no weight on data for 2020 and 2021.

As weights do not affect projections linearly, placing a 10% weight on data for 2022 and 2023 results in a projection that falls nearly half-way between a projection that places no weight on these years and one that gives them full weight.

Cobus Daneel, Chair, CMI Mortality Projections Committee, said:

“While mortality since 2022 has been less volatile, mortality rates are still higher than what we expected prior to the pandemic which could plausibly be interpreted in a few ways: Were our pre-pandemic views too optimistic? Are there lingering short-term effects that will rapidly fade out as we revert to the pre-pandemic trend? Or did the pandemic have a fundamental impact on the longer-term trend?

“We have aimed to strike a balance between differing views with our proposals for CMI_2023 which would lead to similar life expectancies as in CMI_2022.

“We are conscious that the outlook for mortality remains uncertain and there is a range of reasonable projection methods and projected mortality rates. We are consulting on our proposals to gauge the views of users of the model. Given the uncertainty, we encourage and expect many users to modify the Model parameters or methods to reflect their own portfolios and their views of the impact of the pandemic.”

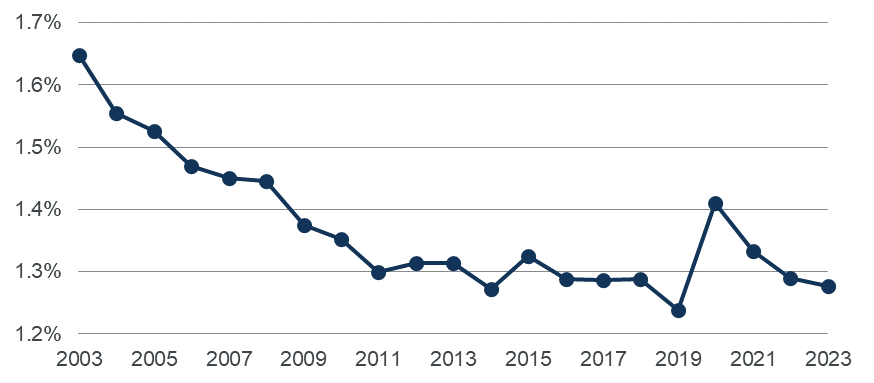

Chart A shows standardised mortality rates (which allow for consistent comparisons of mortality over time) for ages 20 to 100 in the general population of England & Wales from 2003 to 2023. Standardised mortality rates fell relatively rapidly in the period to 2011 and relatively slowly between 2011 and 2019. Mortality rose sharply in 2020 because of the COVID-19 pandemic. It subsequently fell and mortality in 2022 and 2023 was at a similar level to 2016 to 2018.

Chart A: Standardised mortality rates for ages 20 to 100 in England & Wales since 2003

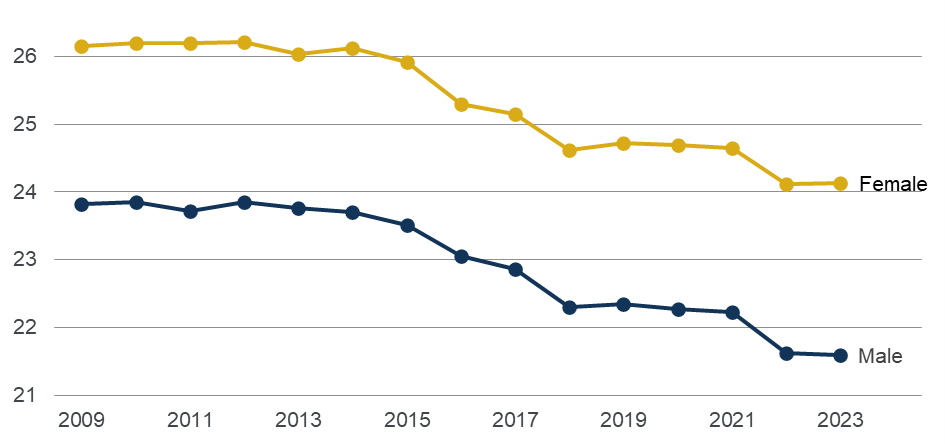

Chart B shows the progression of cohort life expectancy at age 65 in successive versions of the CMI Model. The figures for the proposed version of CMI_2023 are around two years lower than in the first version, CMI_2009.

Chart B: Cohort life expectancies as at 1 January 2024 at age 65 from the proposed version of CMI_2023 and earlier versions

The cohort life expectancies shown in Chart B for different versions of the CMI Model reflect a combination of mortality rates at the time and likely mortality improvements in later years. The fall in life expectancy since CMI_2009 is mainly due to changes in views of future mortality improvements. At the time of CMI_2009, mortality had been falling rapidly and this was generally expected to continue for some time, leading to relatively long cohort life expectancies. However, the outlook in CMI_2023 is for low mortality improvements in the short term. This leads to lower cohort life expectancies in CMI_2023 than in CMI_2009 even though mortality in 2023 was lower than in 2009.

~ENDS~

Sonia Sequeira, Communications Lead, IFoA

Tel: 07525 592 198

Email: sonia.sequeira@actuaries.org.uk

1. Cohort life expectancy allows for assumed future changes in mortality rates. As future changes are unknown, it is a subjective measure. It is typically used by actuaries who need to use realistic assumptions about the lifespan of pension scheme members or insurance company policyholders. In contrast, period life expectancy only allows for changes in mortality rates to date and makes no allowance for future changes. It is an objective measure that is often reported by the Office for National Statistics.

2. Because mortality rates are higher at older ages, changes in the age distribution of a population can lead to apparent changes in average mortality rates, even if mortality rates at each age do not change. A standardised mortality rate (SMR) can be thought of an average mortality rate for a group of lives, assuming that it has a standard age profile. This enables us to make a consistent comparison of mortality rates over time and between groups. We use the age profile of the 2013 European Standard Population for ages 20 to 100.

3. The CMI Mortality Projections Model (the “CMI Model”) was introduced in 2009 to replace previous projections and has been updated on a broadly annual basis since then. It is based on mortality data for the population of England & Wales, published by the Office for National Statistics.

4. The CMI Model is typically used by UK pension schemes and insurance companies which need to make assumptions about future mortality rates. The Model does not provide an assumption around long-term mortality improvements, requiring users to make their own assessment.

5. Life expectancy for different groups, such as particular pension schemes and groups of policyholders, can vary considerably, and the CMI encourages users of the CMI Model to make appropriate assumptions for the purpose that it is being used for.

Continuous Mortality Investigation Limited (‘the CMI’) is wholly owned by the Institute and Faculty of Actuaries but has an independent executive and management.

The CMI’s mission is to produce high-quality impartial analysis, standard tables and models of mortality and morbidity for long-term insurance products and pension scheme liabilities on behalf of subscribers and, in doing so, to further actuarial understanding.

The Institute and Faculty of Actuaries (IFoA) is a royal chartered, not-for-profit, professional body.

Research undertaken by the IFoA is not commercial. As a learned society, research helps us to fulfil our royal charter requirements to further actuarial science and serve the public interest.

Actuaries provide commercial, financial and prudential advice on the management of a business’s assets and liabilities, especially where long term management and planning are critical to the success of any business venture. They also advise individuals, and advise on social and public interest issues.

Members of the IFoA have a statutory role in the supervision of pension funds and life insurance companies. They also have a statutory role to provide actuarial opinions for managing agents at Lloyd’s of London.

Members are governed by the Institute and Faculty of Actuaries. A rigorous examination system is supported by a programme of continuing professional development and a professional code of conduct supports high standards reflecting the significant role of actuaries in society.

The IFoA is available to provide independent expert comment to the media on a range of actuarial-related issues, including COVID-19 and its long term consequences, mortality, pensions, life and general insurance, health and care, finance and investment, climate change and sustainability, systems thinking, uncertainty and judgement, and risk management.